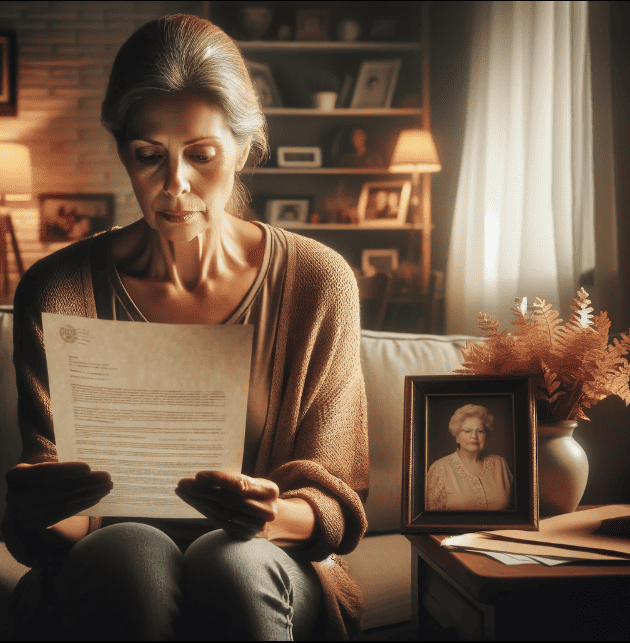

When it comes to planning for the future, there’s one aspect that often feels a bit like solving a puzzle—estate administration. At its heart, this process ensures wishes are honored and loved ones are taken care of. Central to making this happen is one key player: the executor of an estate, also known as a personal representative. You might be wondering, “What is an executor? What do they do?”

If you’re named in someone’s will as the executor of the estate, understanding the role is crucial.

An executor is much more than a title; it’s a commitment to carry out the final wishes of a loved one, often involving legal, financial, and emotional decision-making. It’s about gathering assets, squaring away debts, and ensuring beneficiaries receive what’s rightfully theirs, all while navigating the complexities of the law.

But let’s be real: the role can sound daunting, especially if legal jargon isn’t your first language.

So, let’s look at the role of an executor, making it not just understandable but approachable because everyone deserves to feel confident and prepared for such an important responsibility.

Definition of an Executor of Estate

Let’s dive right in—what exactly is an executor? An executor is the director of a deceased person’s final act, making sure the stage is set just as they wished.

In North Carolina, the estate executor steps into the decedent’s shoes after they pass away, wrapping up their life’s financial and legal affairs. The executor is the one calling the shots (along with the probate court), from paying off the last credit card bill to ensuring Aunt Sally gets that heirloom vase she was promised.

Legally speaking, the executor is the person nominated in the will to carry out an individual’s last wishes.

If you’re scratching your head thinking, “I didn’t know someone appointed me as an executor until today,” don’t worry. If you can’t do the job, the court steps in to appoint someone. In North Carolina, this is usually a close family member.

The law has a pecking order for these things, ensuring someone responsible takes the helm.

Being a Personal Representative Is a Big Job

But here’s the kicker: being an executor isn’t just an honor. It’s a job. A big one.

North Carolina General Statutes lay out the role in black and white, but let’s keep it simple. (Chapter 28A-2-4) A deceased person’s executor:

- Gathers up everything owned by the deceased person and inventories it all

- Pays the debts of the deceased person (including final taxes)

- Distributes what’s left over to the people or organizations named in the will

An executor acts as the bridge between the will’s wishes and the real world, making sure everything goes smoothly in probate court.

This role is vital. It’s about trust, responsibility, and a whole lot of organization. Filling these shoes is a decision not to be taken lightly. But remember, it’s also a decision that lets you handle a loved one’s legacy with care and respect.

Duties of an Executor

So, now that you understand a bit about what an executor does, let’s talk about the role a bit more.

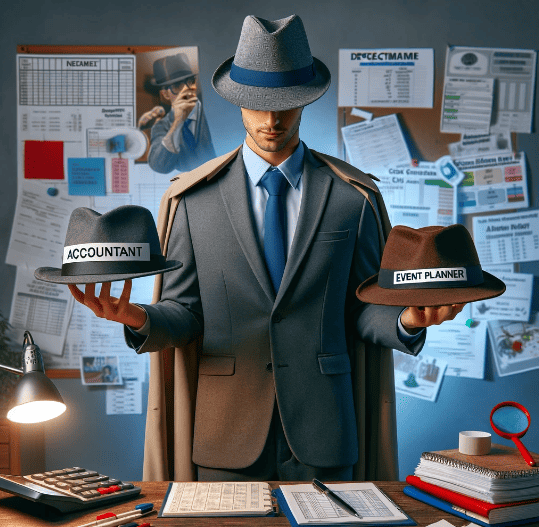

Imagine an executor as the manager of a complex project. Your job description? It’s a mix of accountant, detective, and event planner, all rolled into one.

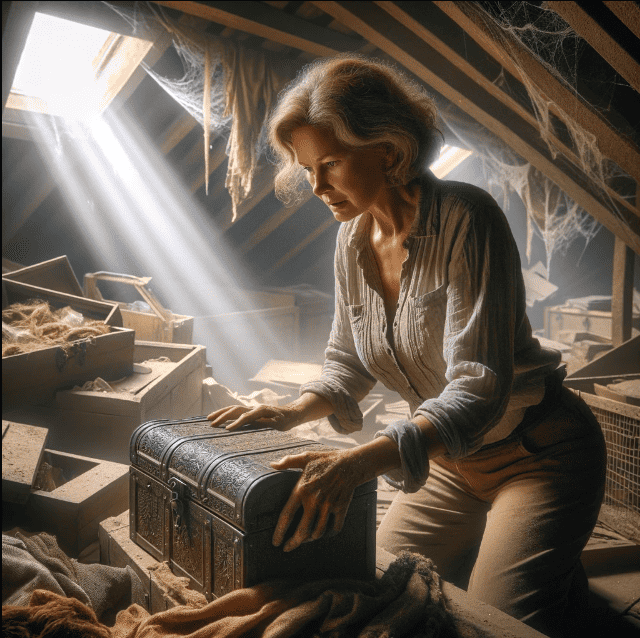

First up, you need to get a handle on everything the person owned—the house, car, bank accounts, the vintage guitar collection, everything.

It’s a bit like a treasure hunt, but instead of a map, you use the last will and other documents they’ve left behind.

North Carolina law gives executors the authority to gather and take control of the person’s assets. (N.C. Gen. Stat. § 28A) You’re not making decisions on a whim; you’re following the roadmap (the law).

Next, you’re on to paying debts and taxes. Before anyone receives a cherished heirloom or a penny, you must settle the debts.

As an executor, you use the estate’s assets to pay off creditors. This ensures all the financial obligations are squared away. It may feel like juggling, balancing the need to pay debts with the available assets.

And finally, distributing the assets. This is where the executor turns the last wishes into reality, ensuring each beneficiary receives what was left to them. Whether it’s a specific bequest or a share of the residue of the estate, you ensure the gifts reach the right hands.

It’s a responsibility outlined in N.C. Gen. Stat. § 28A, ensuring that last wishes are honored to the letter.

Executorship is No Small Feat

Throughout this process, you’ll also navigate legal paperwork and likely court appearances, especially if the estate goes through probate. It’s a role that demands attention to detail, patience, and a steady hand at the wheel.

Being an executor is no small feat. It’s a role that requires a blend of diligence, tact, and a deep sense of duty. You’re not just managing assets; you’re honoring a life and legacy.

You stand in another’s place, making decisions with care and respect, ensuring their final wishes are carried out just as envisioned.

Qualities of a Good Estate Executor

Next, let’s see what qualities a good estate executor needs to possess. After all, you will do the following and more in this role:

- Stand in front of a probate court

- Organize valuables

- Inventory of an estate’s assets

- Pay debts and creditors

- Help loved ones receive whatever estate assets they inherited

Willingness to Seek Help

Willingness to seek help is the best virtue you can possess as an executor. No one expects you, as executor of an estate, to know everything.

The best executors know when to consult an estate administration or probate lawyer, an accountant, or an appraiser to ensure they’re making the best decisions for an estate.

Trustworthiness

Trustworthiness is key. You’re managing personal property and making important decisions after a life is over. You must be reliable and trustworthy.

After all, you will hold the keys to another’s personal treasure chest. You want to guard it well.

Organizational Skills

Organizational skills are non-negotiable unless you have the help of a very organized estate administration attorney.

The role of estate executor involves a lot of paperwork, court deadlines, and details.

An ideal executor is someone who can keep track of things without breaking a sweat. If you plan trips down to the last detail or keep your tax records in impeccable order, this role will likely not be difficult for you.

Financial Savvy

Understanding finances is a huge plus. You don’t need to be Warren Buffett, but a good understanding of finances helps. This could mean you are good with your own budget, have experience in business, or simply don’t get flustered when numbers are involved.

In North Carolina, as of now, there is no need to pay estate taxes. However, Federal estate taxes can come into play with larger estates.

Patience and Diplomacy

These characteristics are crucial. As the executor, you may deal with family members, beneficiaries, and possibly even disputes.

If you can navigate these waters smoothly, keeping a cool head and a warm heart, you’ll be worth your weight in gold as an executor of the estate.

Availability

An executor’s role can be time-consuming. Ensure you have the time to dedicate to settling an estate, especially if you have a busy life or career.

An executor with the above qualities can steer the estate ship through uncharted waters. It’s not just about fulfilling duties; it’s about doing so with care, respect, and a sense of duty to your legacy.

The Legal Process for Executors

Stepping into the role of an executor is like embarking on a journey through a legal maze.

It’s complex, yes, but with the right map and compass and maybe a bit of help from professionals, it’s entirely navigable. Let’s break down this journey, avoiding the legalese that makes most folks’ eyes glaze over.

What is “Probate?”

First off, there’s this thing called probate. Think of it as the official kickoff, where the court says, “Alright, let’s make this will official.”

In North Carolina, like in many places, probate is the process where the court probates the will. It’s also where you get the official nod to start your duties. Probate court is not always required for every single asset, but for many estates, it’s a necessary step.

Proving the Will

During probate, you will submit what you believe is the last will so the court can “prove” it—basically, showing it’s legit and the last one that was made.

Making An Inventory of the Estate’s Assets

You’ll file the last will with the North Carolina probate court, along with a list of the person’s assets and debts.

It’s a bit like taking inventory before a big sale, ensuring everything is accounted for before anything moves.

This is where you may need to hire an appraiser if the person left behind any valuable personal property and you’re unsure what it is worth.

Managing the Estate

Here’s where the executor’s job gets real. You’ll need to manage the estate’s assets, which might involve everything from safeguarding property to making sure investments you handle investments wisely.

You’ll also pay off any debts and taxes. Your role is like being a temporary CFO for an estate, making sure all the financial dots are connected.

Distributing Assets to Heirs

After the debts are paid and the court gives the green light, your executor will distribute the remaining assets to your beneficiaries. This is the part where the wishes outlined in the will finally come to life. It’s the culmination of the journey, where the individual’s legacy is passed on.

It’s a team effort, with you as the executor at the helm, steering through the legalities to ensure you honor the person’s wishes precisely as they intended.

Remember, the role of an executor is grounded in trust and responsibility. While the path you navigate has legal steps, it’s all in service of honoring wishes and ensuring a legacy lives on.

It’s a significant role, filled with both challenges and rewards, embodying the final act of care and respect for a life well-lived.

Challenges An Executor of Estate May Face

Navigating the role of an executor can sometimes feel like you’re the main character in a complex drama filled with unexpected twists and turns.

It’s a role that’s both honor and duty, often accompanied by challenges requiring a blend of patience, wisdom, and, sometimes, a thick skin.

Let’s talk about those challenges and how you, as an executor, can manage them with grace.

Family Dynamics

Imagine a family dinner where no one is on the same page—now add the emotional weight of inheritance and grief.

It’s no surprise that tensions can run high. As an executor, you’re in the hot seat, making decisions that might not please everyone.

The key? Communication and transparency. Keep all parties informed, involve a neutral mediator if necessary, and always, always stick to the wishes laid out in the will.

It’s not about taking sides; it’s about respecting the departed’s decisions.

Complex Estates

Some estates are like a jigsaw puzzle with too many pieces. You might be dealing with multiple properties, investments across states, or even international assets.

It’s complex, and there’s no shame in feeling overwhelmed.

This is where assembling a team of professionals—lawyers, accountants, financial advisors—can be a game-changer.

They can help you navigate the intricacies, ensuring you’re making informed decisions every step of the way.

Emotional Toll

Acting as an executor is not just a legal role; it’s a deeply personal one. Managing an estate while mourning can be incredibly challenging.

It’s important to acknowledge the emotional weight of what you’re carrying and allow yourself space to grieve.

Lean on friends, family, or a professional counselor. Remember, taking care of yourself isn’t just okay; it’s necessary.

Balancing Act

For most, being an executor isn’t a full-time job—it’s something that comes on top of already busy lives. Finding the balance between your duties as an executor and your personal and professional life can be tricky.

Set realistic expectations with beneficiaries about timelines and progress. Don’t hesitate to delegate tasks to professionals where possible, and remember, it’s a marathon, not a sprint.

Facing these challenges head-on, with both determination and sensitivity, can make all the difference in fulfilling your role effectively.

It’s about navigating the stormy waters with a steady hand, keeping your eyes on the horizon—honoring the wishes of the loved one who trusted you with this pivotal role.

And remember, it’s a journey not just of duty but of heart, a final act of service to someone who placed their ultimate trust in you.

Does An Executor of Estate Receive Compensation?

Now, let’s get down to brass tacks: Executor of Estate Compensation. It’s a topic that often raises eyebrows. “Wait, you mean I get paid to do this?” Yes and no. Let’s unpack it in a way that doesn’t feel like we’re reading the tax code.

In North Carolina, like in many states, executors are entitled to compensation for their time and effort. It’s not a windfall but rather a recognition of the significant work involved in managing an estate.

Think of it as a modest salary for a job that requires meticulous attention to detail, a fair amount of legal legwork, and, often, a whole lot of patience.

Here’s the Lowdown

The amount an executor of an estate gets paid is typically based on the estate’s size and complexity. North Carolina General Statutes provide a framework, but the exact figure can vary.

It’s somewhat akin to a commission-based job—the larger the estate, the larger the potential compensation. However, it’s important to note that this compensation is subject to approval by the probate court, ensuring it’s fair and justified.

But here’s the kicker: If you’re serving as the executor of an estate for a loved one, you might feel uncomfortable about the idea of getting paid. It’s a personal decision.

Some choose to waive their fee, especially if they’re also inheriting from the estate. It’s a gesture of goodwill, a way of saying, “I’m doing this out of love, not for financial gain.”

Whether you choose to accept compensation or not, it’s crucial to keep transparency at the forefront. Communicate with the beneficiaries about your decision and the reasons behind it. It helps maintain trust and harmony among everyone involved.

Being an executor is a role that comes with its fair share of responsibilities, challenges, and, yes, even compensation. It’s about striking a balance between honoring your duties and recognizing the personal investment of time and energy required to do the job well.

And remember, at the heart of it all, you’re carrying out the final wishes of someone who trusted you implicitly—a role of both honor and service.

Comprehensive Estate Administration Legal Services

At Hopler, Wilms, and Hanna, we understand that navigating the world of probate courts, wills, accounting, and paying the bills of an estate can feel overwhelming.

That’s where we step in. We’re more than just legal advisors; we’re your partners in ensuring that you can honor a legacy exactly as they envisioned.

Our team of experienced attorneys focuses our work on estate planning and administration. We offer personalized guidance tailored to your unique situation.

If you’re stepping into the role of personal representative, we’re here to make the process as smooth and straightforward as possible. We offer comprehensive services, including:

- Assisting executors with estate administration tasks

- Navigating the probate process

- Estate advice for tough decisions as an executor

- Resolving disputes among beneficiaries

- Helping with will contests

We believe in a compassionate, client-centered approach. Our goal is to make legal jargon and processes easy to work with, empowering you to make informed decisions with confidence.

We’re here to answer your questions, offer advice, stand in your stead, and provide the support you need during what can often be an emotional time.

Get in touch if you’re feeling daunted by the estate administration process. We work with individuals across the state to make probate easier and more understandable for all. Get in touch today and find out how we can help.