If your loved one has passed away, the court or other organizations may ask you whether they died testate or intestate.You may already be overwhelmed dealing with the grieving process and having complicated and unfamiliar vocabulary thrown at you just makes it more difficult. Don’t worry, this article will explain a little more about what these terms mean as well as what the order of succession is for someone who passes away intestate.

Testate vs. Intestate

Testate: A person who passes away with a last will and testament. A will allows you and your loved ones to decide who gets what after you die as well as how to manage your estate. Wills are not just for people who have a lot of money, even though that’s what popular culture wants you to believe. If you own a home, a car, property, or have bank accounts or retirement accounts, you may want to get a will so these can be dealt with how you want them to be, rather than what the default is.

Intestate: A person who passes away without a last will and testament. Without a will to tell your loved ones how to handle your belongings, they will need to follow the law of intestate succession which is a series of North Carolina laws and statutes that explain how to divide up your property and accounts and distribute them to your family. The law of intestate succession tells us who gets what after the payment of the year’s allowance, costs of administration, payment of debts and claims, and payment of taxes.

Law of Intestate Succession: Who?

If your loved one dies intestate (without a will), you may wonder who gets what in the estate. Without a will, you might not know what your loved one wanted or you may not be able to follow their wishes. According to the law of intestate succession, the order of priority goes:

- Spouse. If your loved one had a husband or wife, they are the first person in the line of succession. However, as described below, they aren’t entitled to everything just because they are your spouse.

- Lineal Descendants: Any children, grandchildren, or remote descendants your loved one had share priority with the spouse to some degree.

- Parents. If your loved one’s mother and/or father are still alive, they are the third priority. They also may share some priority with the spouse if there are no descendants.

- Siblings. After your loved one’s parents come to their brothers and sisters.

- Siblings Lineal Descendants: Your loved one’s siblings’ children and grandchildren (nieces and nephews and grand-nieces and grand-nephews) come after their parents (your loved one’s brothers and sisters)

- Grandparents. Last, in line are your loved one’s grandmother and/or grandfather if they are still alive, or their descendants if not.

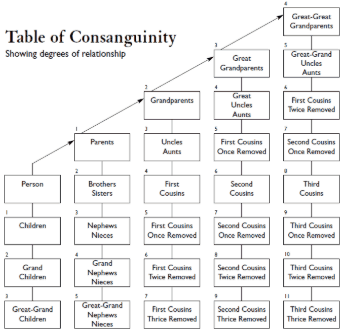

The below image can help you determine where your family members are in the family tree and determine what order they fall in for the law of intestate succession.

Law of Intestate Succession: How?

If your loved one passes away intestate, how their estate is divided depends upon what type of property they have as well as who is still living in their family tree. The Law of Intestate succession starts with your loved one’s husband or wife, then moves on to children and lineal descendants, then onto other family members. Read on to see how your loved one’s estate will be divided without a will.

Spouse:

- Real Property (or, houses and land, but not real property that passes by some other mechanism, like certain types of jointly-held property)

- If your loved one had a spouse and only one living child OR the child’s lineal descendants if the child has already passed away, the spouse gets one half (50%) of the real property

- If your loved one had a spouse and two or more living children OR one child and any lineal descendants of one or more deceased child OR the lineal descendants of two or more deceased children, their spouse gets one third (33.3%) of the real property

- If your loved one had a spouse and no children or lineal descendants but is survived by their parent or parents, their spouse gets one half (50%) of the real property

- If your loved one had a spouse but no children and their parents have also passed away, their spouse gets all of the property (100%)

- Personal Property (or, everything else not passing through some mechanism, such as by beneficiary designation on an account)

- If your loved one had a spouse and only one living child OR the child’s lineal descendants if the child has already passed away AND the total amount of personal property does not exceed $60,000, the spouse gets all of the personal property (100%). If the amount of the personal property is more than $60,000, the spouse gets $60,000 as well as half (50%) of the remaining amount.

- For example, if the personal property in your loved one’s estate was worth $100,000, their spouse would get $60,000. That would leave $40,000. Their spouse would then get half of that $40,000, or $20,000. In total, they would get $80,000 and your loved one’s child would get the other half of the $40,000, or $20,000.

- If your loved one had a spouse and two or more living children OR by one child and any lineal descendants of one or more deceased child OR by the lineal descendants of two or more deceased children AND the total amount of personal property does not exceed $60,000, the spouse gets all of the personal property (100%). If the property is worth more than $60,000, the spouse gets $60,000 as well as one third (33.3%) of the remaining amount.

- For example, if the personal property in your loved one’s estate was worth $120,000, their spouse would get $60,000. That would leave $60,000. Their spouse would get one-third of that $60,000, or $20,000. In total, their spouse would get $80,000 and your loved one’s children would split the remaining amount of $40,000

- If your loved one had a spouse but no children or lineal descendants, but is survived by a parent or parents, and the property is not worth more than $100,000, their spouse gets all of the personal property. If the property is worth more than $100,000, the spouse gets $100,000 as well as one half (50%) of the remaining amount.

- For example, if the personal property in your loved one’s estate was worth $150,000, their spouse would get $100,000. That would leave $50,000 left. The spouse would get half of that $50,000, or $25,000. Their parents would get the remaining $25,000.

- If your loved one is not survived by any children or their lineal descendants or by a parent, their spouse gets all of the personal property (100%).

No Spouse (either never married or spouse has already passed away):

- If your loved one has no spouse but has a child OR parents:

- If your loved one had one child OR that child passed away with one lineal descendant, the child or the lineal descendant will inherit the whole estate

- If your loved one had one child AND that child has already passed away with more than one lineal descendant:

- Your loved one’s grandchildren (their child’s lineal descendants) get their share figured out by dividing the property by the number of surviving grandchildren plus the number of deceased grandchildren who left lineal descendants.

- Your loved one’s great-grandchildren (their grandchild’s lineal descendants) get their share by dividing the property by the number of surviving great-grandchildren plus the number of deceased great-grandchildren who have left lineal descendants surviving the estate

- Your loved one’s great-great-grandchildren (their great-grandchild’s lineal descendants) get their share by dividing the property by the number of surviving great-great-grandchildren who have left lineal descendants surviving the estate

- If your loved one has other lineal descendants of their children not listed above, then any property will be divided the same way as above for anyone else.

- If your loved one had no spouse and no children but their parents are still alive, their parent or parents get the entire estate.

- If your loved one has no spouse, no children AND their parents are already deceased:

- If they had any brothers or sisters, or the lineal descendants of any siblings that have already passed away, their share is determined by dividing the property by the number of siblings who are still alive plus the number of siblings who have already passed away who have left lineal descendants.

- For any brothers or sisters who have passed away but had children (these would be your loved one’s nieces and nephews), the property will be divided by the number of nieces and nephews who are still alive plus the number of nieces and nephews who may have already passed away who left lineal descendants.

- For any nieces or nephews who have already passed away but left grandnieces and grandnephews, their share is determined by dividing the property by the number of surviving grandnephews and grandnieces plus the number of deceased grandnephews and grandnieces who left lineal descendants

- If your loved one had grandnieces and grandnephews who have already passed away, but had great-grandnephews and great-grandnieces, their share is figured out by dividing the property by the number of great-grandnieces and great-grandnephews who are still alive plus the number of great-grandnieces and great-grandnephews who left lineal descendants.

- If your loved one has no spouse, children, parents, brothers or sisters, or nieces or nephews but their grandparents are still alive, the paternal grandparents (or your loved one’s father’s parents) get one half (50%) of the estate equally, meaning both their paternal grandmother and paternal grandfather get an equal part of the estate. If one of their paternal grandparents has already passed away, the other gets the whole 50%. If neither paternal grandparent is alive, the 50% goes to the paternal aunts and uncles (your loved one’s father’s brothers and sisters) and their lineal descendants (your loved one’s first cousins).

- Aunts’ and Uncles’ shares are determined by dividing the property by the number of surviving aunts and uncles plus the number of deceased aunts and uncles who have left children or grandchildren who are still alive.

- If your loved one’s aunts’ and uncles’ have already passed away, their children’s shares are determined by dividing the property by the number of surviving children plus the number of deceased children who left lineal descendants

- If your loved one’s aunt’s and uncle’s children have already passed away but have living children (your loved one’s aunts’ and uncles’ grandchildren), their shares are determined by dividing the property by the number of surviving children plus the number of children who are already deceased and who have left lineal descendants.

- Their maternal grandparents (your loved one’s mother’s parents) get the other half (50%) of the estate in equal shares. If one maternal grandparent has already passed away, the other gets the entire 50%. If neither maternal grandparent is alive, the 50% goes to the maternal aunts and uncles (your loved one’s mother’s brothers and sisters) and their lineal descendants.

- If your loved one’s paternal grandparents have already passed away and there are no paternal aunts or uncles, then their maternal grandparents or aunts and uncles and their lineal descendants will get the whole amount of the estate (100%)

- If your loved one’s maternal grandparents have already passed away and there are no maternal aunts or uncles, then their paternal grandparents or aunts and uncles and their lineal descendants will get the whole amount of the estate (100%).

Congratulations if you’ve made it this far! The laws of intestate succession can get complicated, especially if your loved one was not married and had no children. A will is important to avoid this process if you’re able to, especially if you are in a committed relationship but do not want to get married or if there are children in your relationship who are not yours (for example, stepchildren who you did not legally adopt).

Unfortunately, without a will, your family has to follow the laws of intestate succession, which can lead to headaches or actual harm for people who are not “legally” family-like girlfriends, boyfriends, or step-children. If you’re unsure about heirs or about what your rights are in the laws of intestate succession, the attorneys at Hopler, Wilms, & Hanna handle both testate and intestate estates and would be happy to set up a consult with you to discuss your role and answer your questions about your loved one’s estate.

Law of Intestate Succession: Elective Shares and Life Estates for Spouses (Because It Wasn’t Complicated Enough)

Even if your loved one left a will, your loved one’s spouse may be able to take what is called an “elective share” instead of what they were left in the will. This share is based on how long they were married.

- If your loved one was married for less than five years, their spouse can get 15% of the total net assets.

- If your loved one was married between five and ten years, their spouse can get 25% of the total net assets.

- If your loved one was married between ten and fifteen years, their spouse can get 33% of the total net assets.

- If your loved one was married for more than fifteen years, their spouse can get 50% of the total net assets.

Your loved one’s spouse also has the option of a life estate which is equal to one third the value of all the real estate or by staying in their home for their lifetime and getting ownership of the furnishings. If the value of the home does not equal one-third of the value of all the property, their spouse can claim additional life estate rights in other property to get to that value.

Law of Intestate Succession: Bars to Inheritance

Certain situations may bar or prevent someone from collecting an inheritance from a will or from intestate succession. Read on to find out what may prevent you from collecting an inheritance.

Slayers: A slayer is defined as someone who is convicted of killing a family member or loved one with an interest in their estate. For example, if someone’s son murders their father, the son would be considered a slayer and would not be able to inherit from his father’s estate. However, if a person is found not guilty by reason of insanity, they are not considered a slayer. Essentially, the law acts like the slayer passed away before your loved one meaning that their lineal descendants may still be able to inherit, but that the estate may be open for a long time until the slayer also passes away.

Spouse: A spouse may be barred from their inheritance if:

- They are divorced or have a marriage annulment

- They are separated and living in adultery

- They have abandoned and refuse to live with their spouse at the time of death

- They seek a divorce that is not recognized by North Carolina

- They are in a bigamous marriage

It’s important to not try and rely on these statutes if you can help it since it is often hard to prove these facts after someone dies, though it can be done. The better strategy is to change your plans and consult with an attorney when you have a major life change. It is important to update your will after big life changes like this, or if you get married or remarried, or have a child, to list a few reasons.

Parents: Parents may be barred from their inheritance if they willfully abandoned their child unless they have resumed their care at least one year before their child died or unless they lost custody under a court order and have since complied with all the court orders requiring a contribution to the support of the child.

Although complex, the state does have laws and infrastructure in place to handle estates, including intestate estates where the person died without a will. It can certainly feel complicated and if you are overwhelmed, attorneys at Hopler, Wilms, & Hanna handle both testate and intestate estates regularly.

We would be happy to set up a consult in our office or over the phone to go over your loved one’s estate and to talk about where you stand in the line of succession. It’s also never too late or too early to plan for this yourself and create a simple will or more complicated estate plan to save your loved ones from going through the laws of intestate succession.

Call us or reach out through our contact page. Losing a loved one is hard enough without being forced to blindly navigate the process alone, so having an experienced attorney can prove invaluable.