Estate Planning

Wills, Trusts, Powers of Attorney, Health Care Directives, and Other Tools

to Protect You, Your Family, and Your Assets

Estate Planning Services

With a well-thought-out estate plan, you can prepare yourself and your loved ones for whatever the future holds. When emergencies happen, your family will know how to navigate the situation with your legal guidance. If you have loved ones or any assets, an estate plan is a necessary legal framework to prepare for the inevitable.

No matter what the future holds, we can help you stay well-prepared and ready.

Wills

Avoid intestacy laws, simplify probate, and lower estate administration costs by making your Last Will & Testament. Name guardians for any minor children, choose an executor, and name who receives your property. Learn More

Incapacity Planning

Let a trusted loved one make medical and financial decisions on your behalf if you are unconscious or unable to make decisions for yourself using tools like Powers of Attorney and Health Care Directives. Learn More

Special Needs Trusts

Care for loved ones with special needs or disabilities by establishing a Special Needs Trust to create and preserve eligibility for public benefits while they also receive income from the trust as a supplement. Learn More

Trusts

Trusts can offer unique protection for your assets by sheltering your resources from probate court costs, creditors, public records, and complicated legal processes. Learn More

ESTATE PLANNING PACKAGES

A will is one of the most important estate planning documents you can have. It ensures that your wishes are carried out after you die. But it’s not just for wealthy people – everyone needs a will, no matter how much or how little money they have.

At Hopler, Wilms, and Hanna, we want to help you protect yourself and your loved ones. We offer a wide range of estate planning services, from wills and trusts to healthcare directives and long-term care planning.

We designed our four estate planning packages with you and your needs in mind! Let us help you draw up the legal documents you need to ensure your future is taken care of.

Click a button below to see pricing.

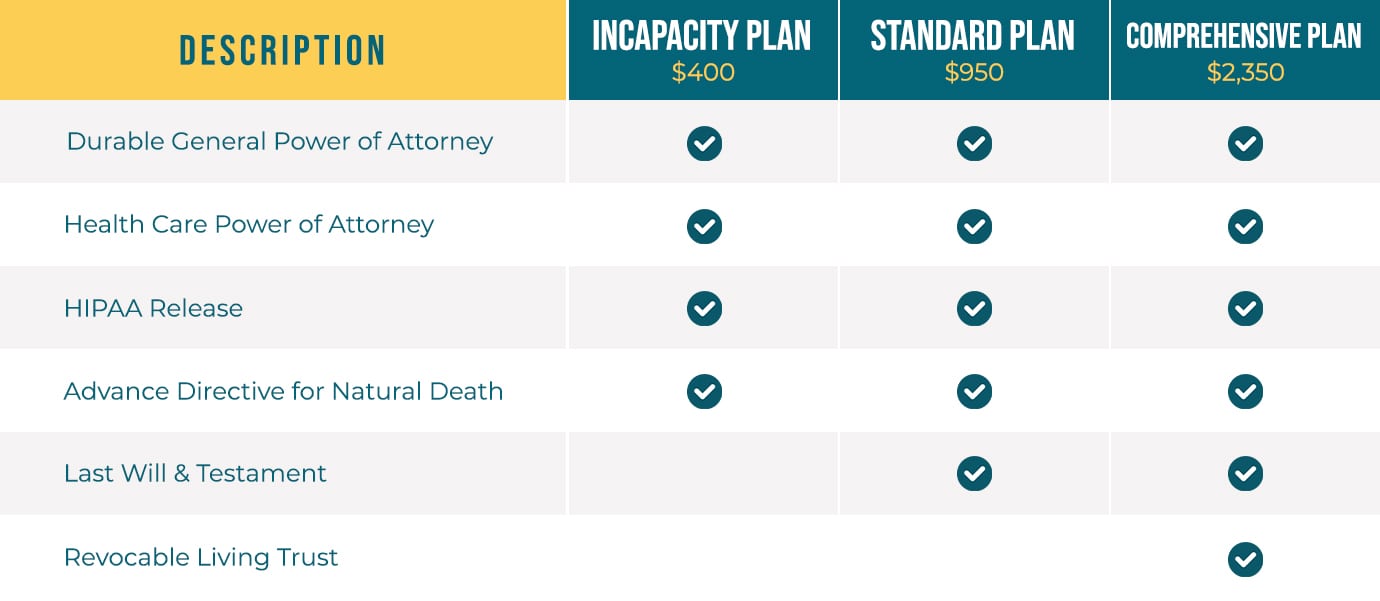

Individual Pricing

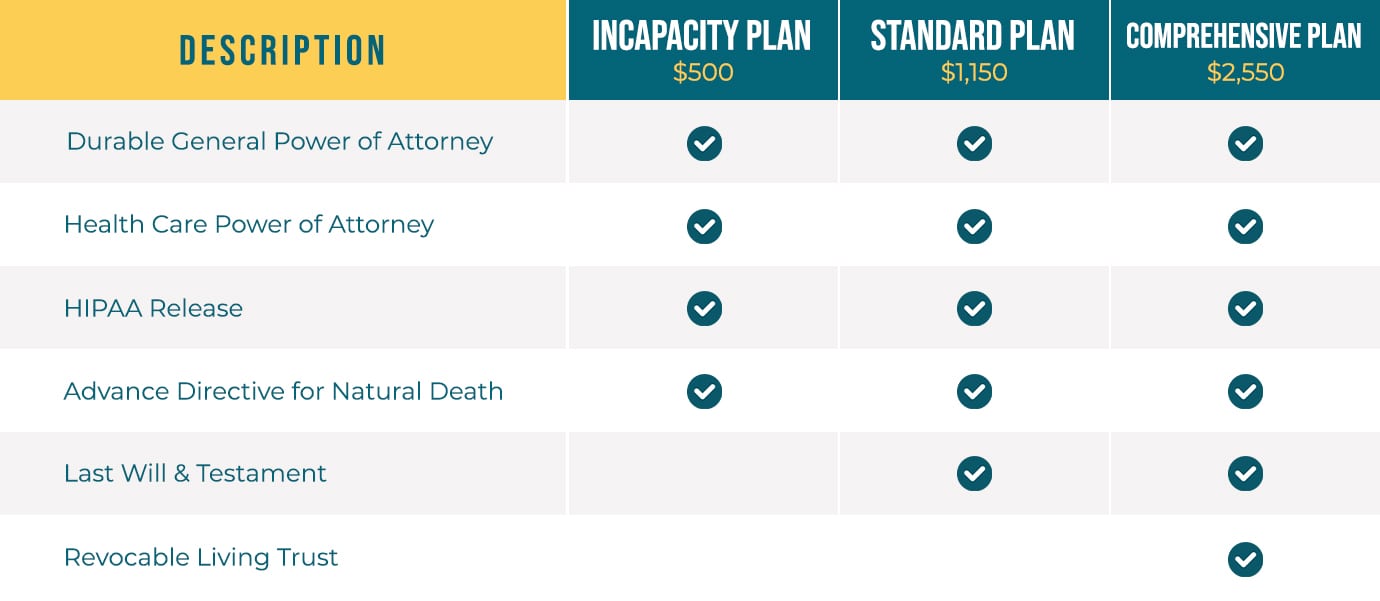

Couple Pricing

Individual Pricing

Couple Pricing

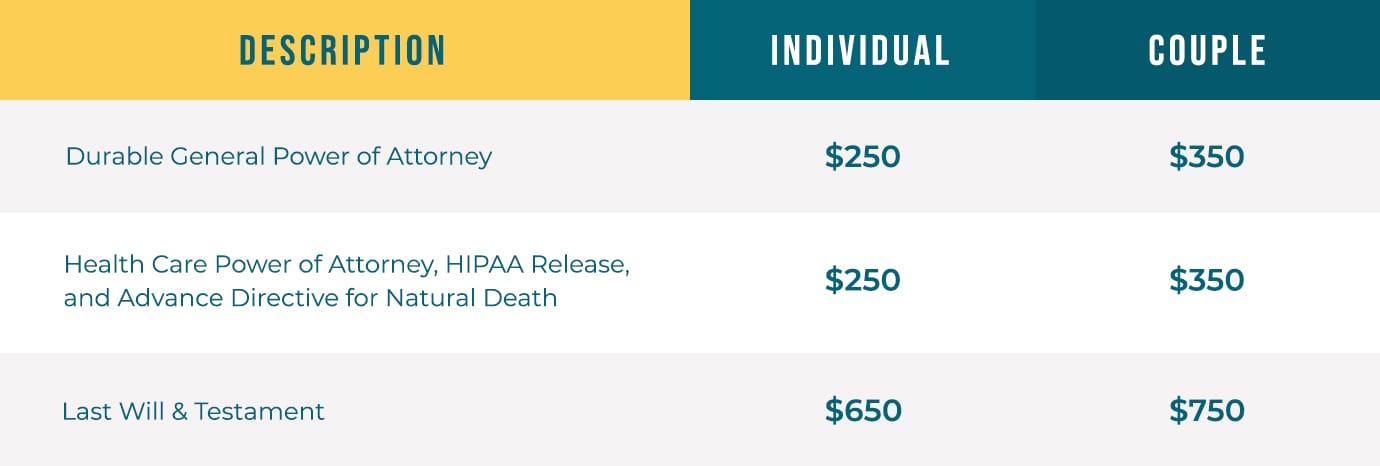

A La Carte Pricing

Typical Estate Planning Documents

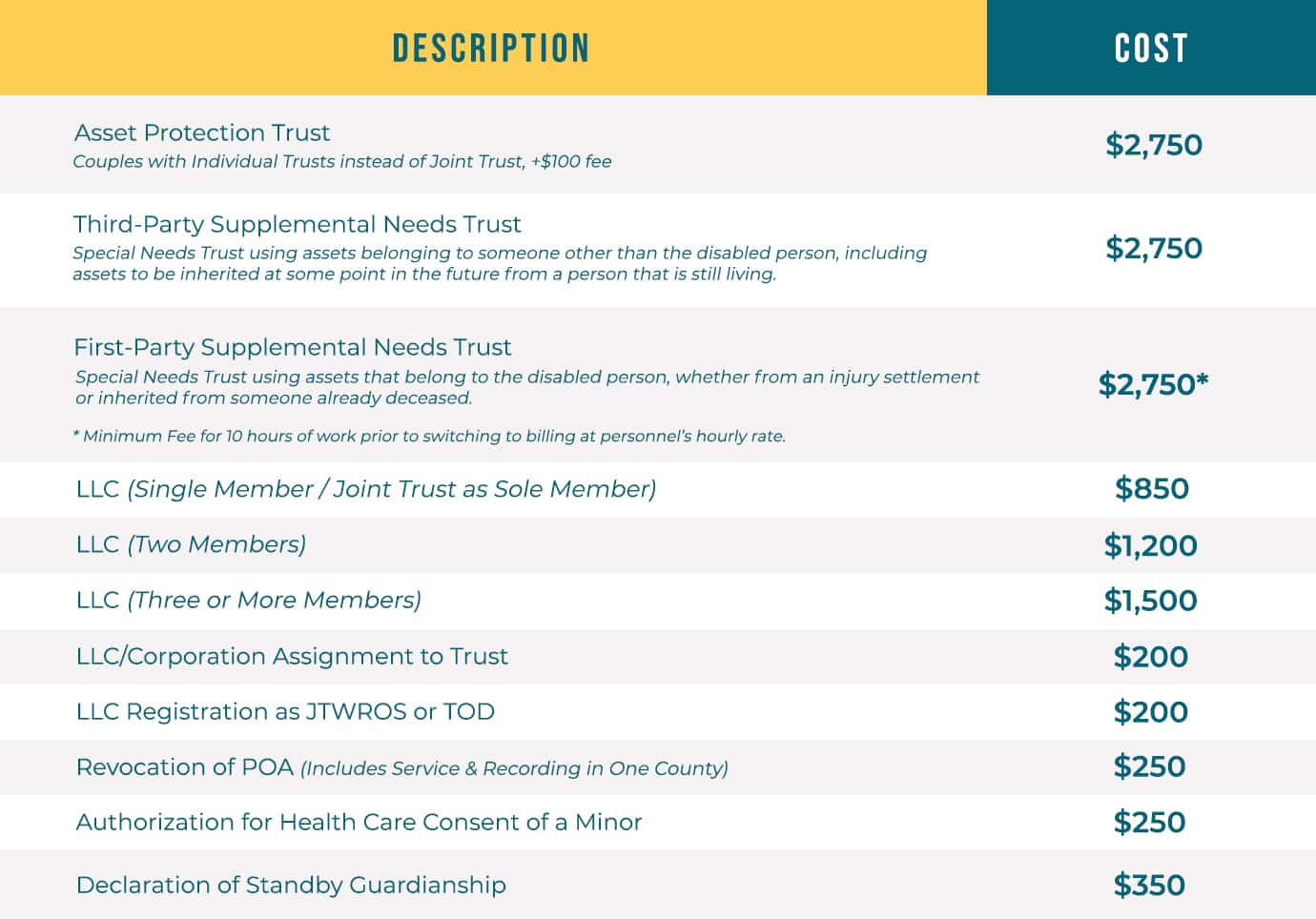

Additional Documents

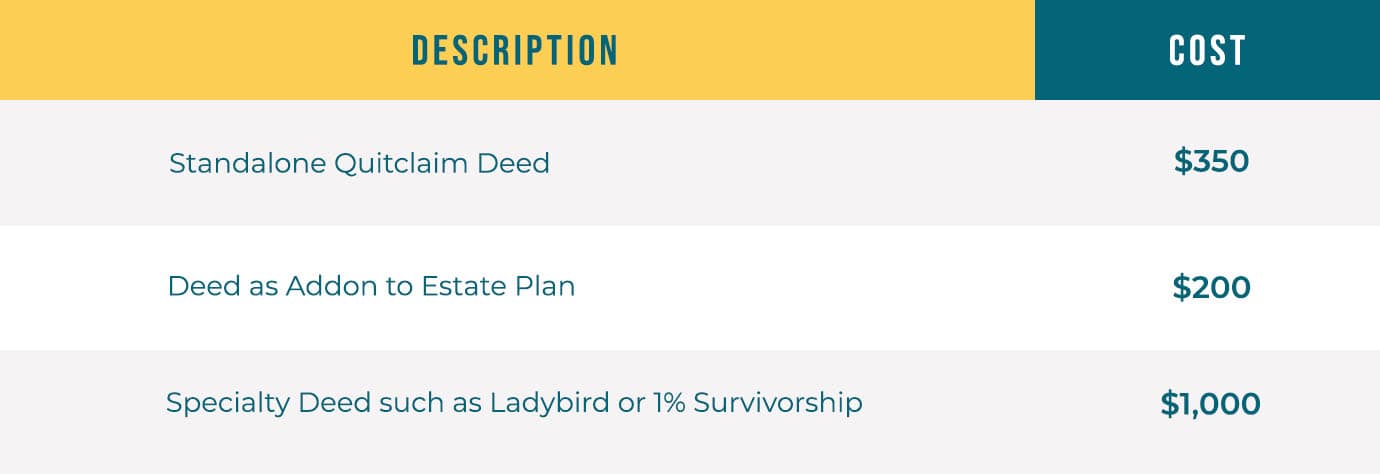

Deeds (including filing fee)

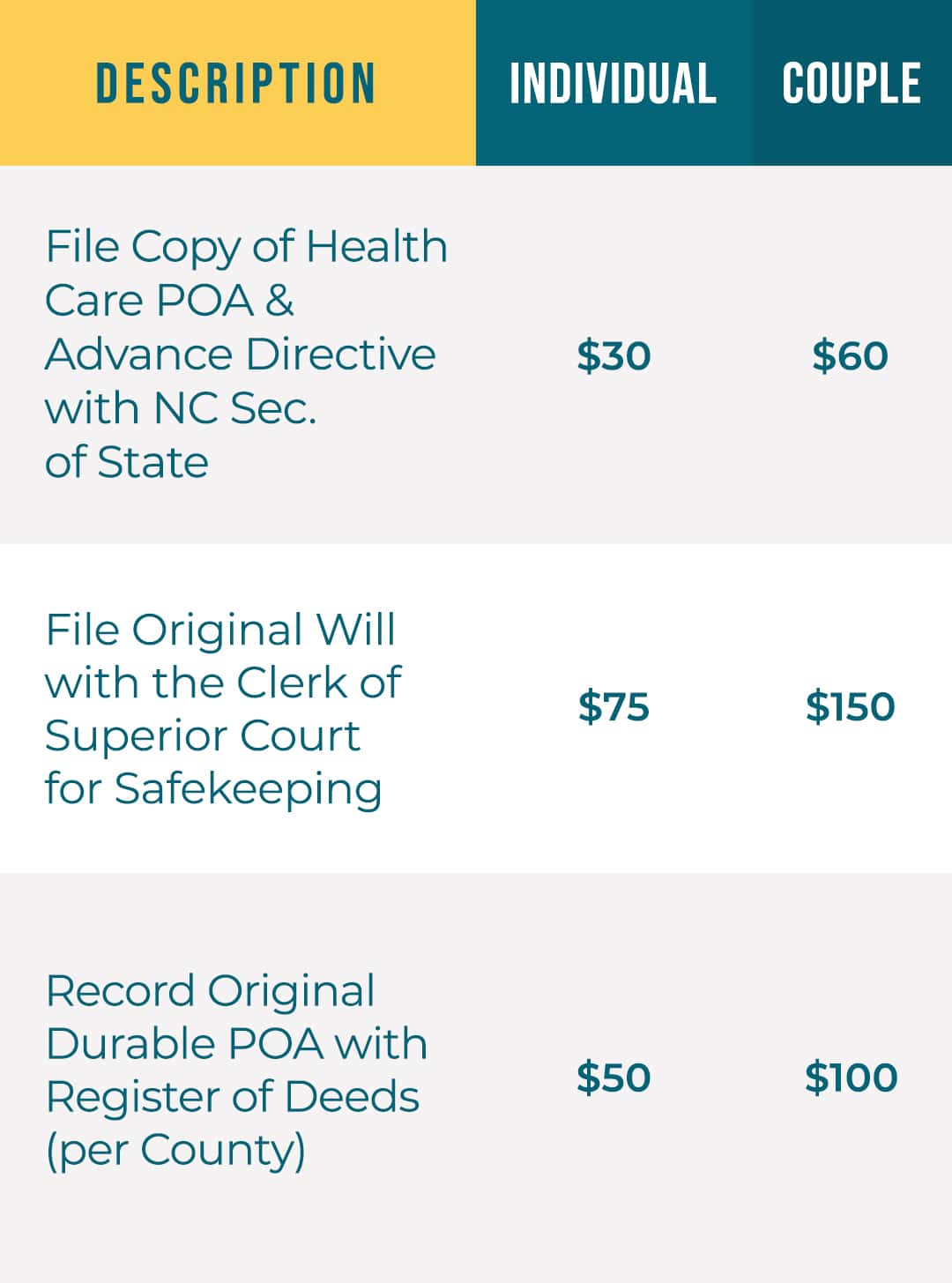

Filing Fees

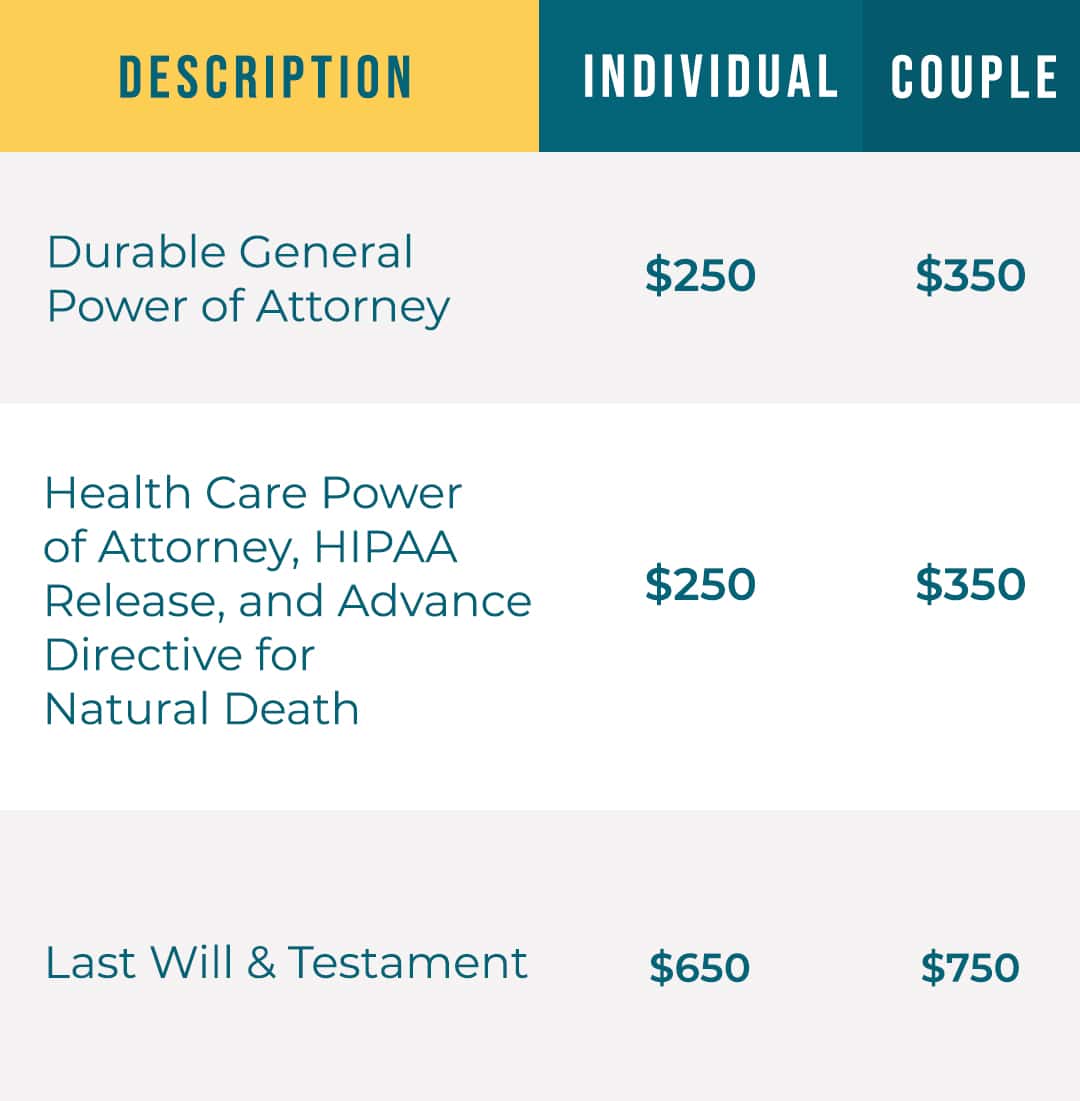

Typical Estate Planning Documents

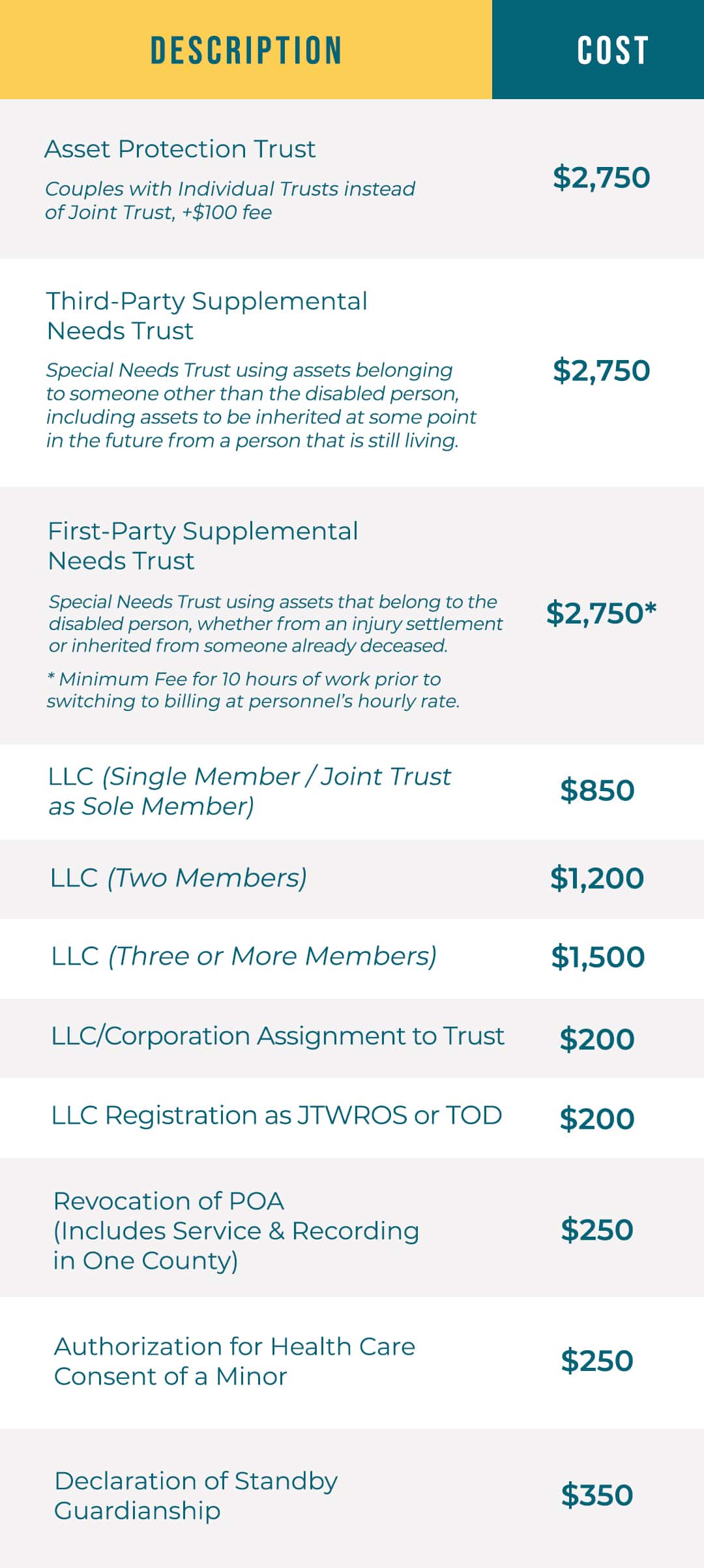

Additional Documents

Deeds (including filing fee)

Filing Fees

Prepare for Life & Death Situations

We know how hard it is to ponder these life and death issues, but you owe it to yourself and your family to make a plan now. Often, when individuals do not plan, their family faces disagreements over how to properly handle various situations. In some cases, this family strife even leads to lawsuits.

Not making decisions now just leaves them for someone else to make later. Do you want your medical decisions made by someone who may not have your best interest at heart? Do you want the laws to decide who receives your property?

If disaster strikes, help your loved ones know how to make medical and financial decisions for their future. Give them the security they need by making your estate plan now.

See What Our Clients Say

I love these guys! Their turn around was quick, most all that I needed was done by phone and everything was flawlessly prepared for me for an on site signing party. And best of all, their costs were more reasonable than the other firms.

–L. Chaiken